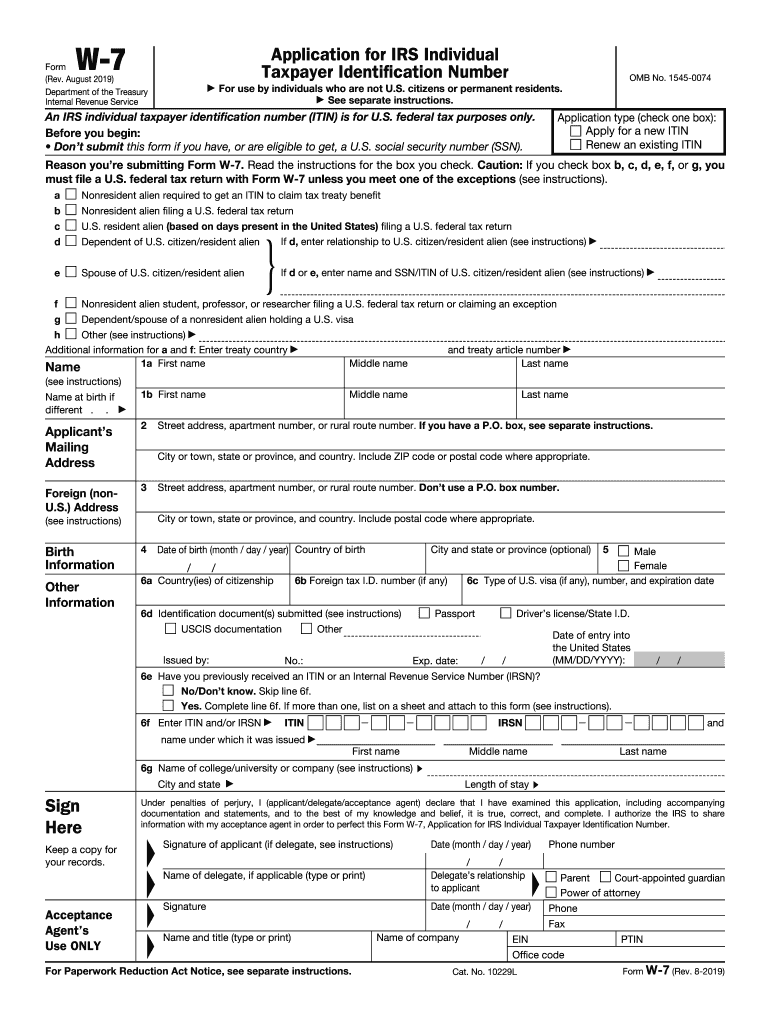

What is the W-7 form?

Form W-7 is the IRS application to get an individual taxpayer identification number (ITIN). This number is needed to identify a person eligible to file individual tax returns with the IRS. Individuals may also use it to apply for the ITIN renewal if it has expired before they need to file their tax return.

Who should file the W-7 form?

Form W-7 or Application for IRS Individual Taxpayer Identification Number is the document for those who need a taxpayer identification number. For instance, completing the w-7 form is necessary for such individuals:

- Permanent US residents without a Social Security Number

- US nonresidents who receive income from US sources and need to pay taxes on them

- Dependents and spouses of the US citizens

- Dependents and spouses of nonresidents who hold a US visa

- Nonresident international students, professors, and researchers filling their tax return or claiming an exception

- Taxpayers who must renew their ITIN due to its expiration

What information do you need when you file the W-7 form?

Before filling out W 7 form, make sure you don't have a Social Security Number or aren't eligible to get one. Then, complete the fields, providing the following information:

- Reason for obtaining an ITIN

- Applicant's details (name, date, and place of birth)

- Applicant's contact details (mailing address and their foreign address)

- Applicant citizenship, country of residence

- Foreign tax ID number, if any

- Type of US visa and its number, if any

- Previous ITIN or IRSN

- List of attached documents to identify the applicant's identity

You can find detailed form w-7 instructions on the Internal Revenue Service website (https://www.irs.gov/forms-pubs/about-form-w-7). Please read them carefully before submitting your application.

How do I fill out form W-7?

The Internal Revenue Service requires taxpayers to file their applications on paper. However, you can fill it out electronically, which is faster and more convenient. To do so, follow the instructions below:

- Upload your W-7 form to the online editor with the Get Form button.

- Start filling it out by checking whether you're applying for a new ITIN or a renewed one.

- Click Next or use the Enter key to move forward.

- Type in all the essential information and check the appropriate boxes in the document.

- Add the current date and click on the Signature field to sign your form electronically.

- Verify your answers and click Done to finish editing.

- Download your sample or choose one of the file-sharing options.

Please note that the applicant or their legal representative must sign form w-7 if they can't do that themselves (these can be legal representatives appointed with the POA, Declaration of Representative, or parents/guardians if the applicant is a dependent under 18 years of age).

With pdfFiller, you can print a document or email it to your delegated representative for signing with just a click. Also, take advantage of the direct Send via USPS option to file your w-7 form to the IRS by mail right from the editor.

Is form W-7 accompanied by other forms?

To apply for an ITIN, the applicant should provide current documents that prove their identity. These can be a birth certificate, passport, US or foreign driving license, US or foreign military ID, medical records (for dependents under the age of 6), school records (for dependents under 18 y.o.). The IRS requires original documentation or certified copies with the w 7 form. The IRS will return all the original documents to the applicant at the mailing address they indicate. You can enclose a prepaid courier or Express Mail envelope to make this return faster, but it's not obligatory. Also, when filing form w-7, you need to accompany it with your tax return.

When is the W-7 form due?

If the person is applying for ITIN for the first time, they must attach the application to the front of the tax return and send it by the date the return is due. In 2022, it's April 18th.

Where do I send form W-7?

Once completed, send your form W-7 together with the tax return report to the IRS office at the address below:

Internal Revenue Service

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342